Total of per unit variable manufacturing and non-manufacturing costs. It is total actual or projected sales revenue for a particular period of time.

It tells us what percentage the contribution margin of sales revenue is. It can be computed by either dividing contribution margin per unit by the sales revenue per unit or total contribution margin by total sales revenue for a specific period.Ĭontribution margin as a percentage of sales revenue:Ĭontribution margin ratio when expressed in percentage is known as contribution margin percentage. The ratio of contribution margin to sales revenue.

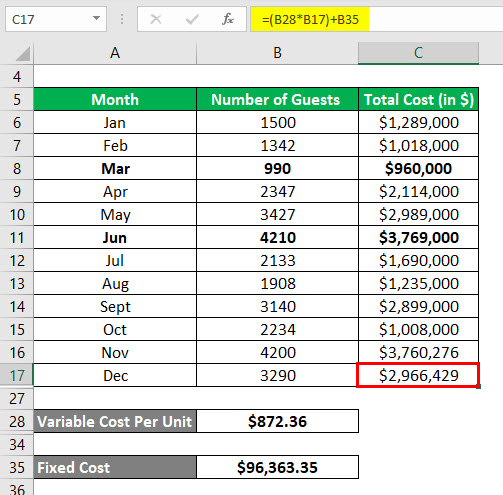

It is the contribution margin that company generates on total units sold for a particular past or projected period. It is the contribution margin that company earns for every single unit that is sold at a particular selling price. Outputs to be generated:įollowing is a list of outputs that CM calculator will generate for you. On the other hand, if company is going to look into future, this field should be filled with number of units that company hopes to sell during a particular future period. If company is going to evaluate its past performance, this field should be filled with actual units sold for a particular past period. Any expense that is variable in nature but does not fall under marketing and selling expenses should also be included in variable non-manufacturing expenses while using above calculator.Ĭontribution margin is calculated to review either past performance or future profitability forecasting. These include variable expenses incurred on marketing and selling activities. For merchandising companies, it includes cost of merchandise sold and the related expenses incurred to get the goods ready for sale such as freight in, wages for loading and unloading the goods. It includes all variable expenses incurred to manufacture a product i.,e, direct materials (including transportation, loading and unloading), direct labor and variable portion of manufacturing expenses. Variable cost of goods sold (COGS) per unit: It is not subject to any discount offered on bulk orders etc. The price at which a business offers its product for sale in the normal course of business.

#VARIABLE EXPENSE PER UNIT CALCULATOR HOW TO#

How to use contribution margin calculator: Inputs required:įollowing is a list of inputs that you must provide to use contribution margin (CM) calculator.

0 kommentar(er)

0 kommentar(er)